Key Provisions of a Stock Purchase Agreement

If you set about to acquire another company, whether through a merger and acquisition (M&A) or an outright purchase, there are two major means of closing the deal: purchasing the company’s assets or purchasing the company’s stock.

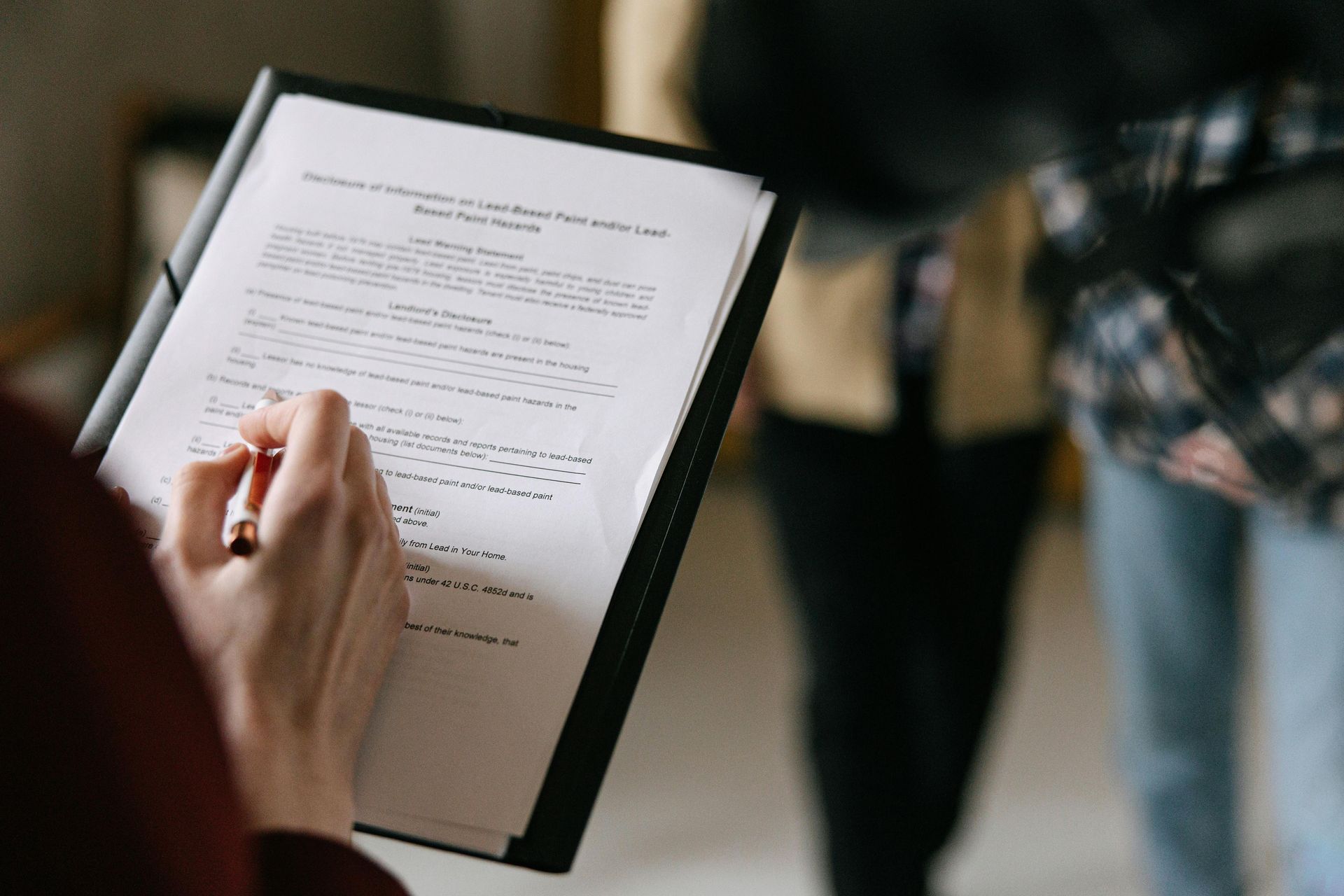

If you seek to acquire the company by taking over the requisite number of its outstanding stock to have majority control – or even 100-percent sole control – you will need to do so through a Stock Purchase Agreement (SPA), sometimes referred to as a Securities Purchase Agreement. In everyday terms, an SPA is a contract between buyer and seller, just like a purchase between a home seller and a homebuyer.

When it comes to acquiring stock, however, there are factors to consider that would not normally be present in a simple home sale and purchase. For instance, the value of the stock can rise and fall, sometimes in a matter of days or even hours. You may agree to a purchase price of $50 a share when the publicly traded shares are going for $42 each, but suddenly those shares plunge to $24.

Also, the stock may be held privately, so in fact, there is no public valuation available. In that case, you will have to do your own valuation of what the company – and therefore, the stock you’re purchasing – is worth.

Whether publicly traded or privately held, stock and its value, and that of the target company itself, need to be addressed with contingency and other clauses in the Stock Purchase Agreement. An SPA is not a simple downloadable form, where all you need to do is fill in the blanks. An SPA needs more thought and input than that.

If you’re seeking to acquire a business in or around Minneapolis or St. Paul, Minnesota, contact the business acquisition attorney at Engel Professional Association.

We bring more than two decades of experience in guiding and advising individuals and businesses in the acquisition of target companies. We will help you draft and finalize a Stock Purchase Agreement that protects your rights and contains provisions for handling disputes and adverse changes that threaten the closing of the deal.

Outside of the Twin Cities, we also work with clients in Mankato, Maple Grove, St. Cloud, and Woodbury, as well as Milwaukee, Madison, and Hudson, Wisconsin.

Stock Purchase and Asset Purchase Agreements

Sometimes the words merger and acquisition are used interchangeably, but that is not actually the case in the real world of M&A.

A merger involves two companies combining to form an entirely new business entity. Each party shares the ownership of the new company while the two previous companies are dissolved. A new management team is put into place as well. Typically, a merger is mutually agreed upon and can be friendlier than an acquisition.

An acquisition involves the absorption of one company by another, but no new entity is created. You sometimes hear the phrase “hostile takeover” when one company uses its resources to acquire another company. That phrase refers to an acquisition that the target company is fighting to stay independent. Not all acquisitions are hostile, however.

One frequent form of acquisition is by financial institutions such as private equity firms that seek to own, but not directly operate, the target of acquisition.

Key Elements of an SPA

A Stock Purchase Agreement is generally broken down into sections known as articles. Typical articles cover definitions of terms used, transaction details, representations and warranties by both buyer and seller, covenants, closing conditions, indemnification, and termination.

- Transaction details include information about the buyer and seller, the purchase price and number of shares to be sold, and the agreed-upon closing date.

- Representations and warranties refer to promises and statements of fact made by both buyer and seller, including their assets and liabilities, intellectual property held, pending legal actions, and any other material fact that may bear on the deal and its success. Warranty means that buyer and seller both warrant that what they’ve disclosed is true and factual.

- Covenants generally cover what the buyer and seller must do, or must avoid doing, for the deal to go through. For instance, the seller will be asked to agree to a covenant not to change the way the business is operated that could result in a decrease in the business’s value.

- The closing conditions article, in a similar vein, will allow either buyer or seller to back out of the deal if any covenants are broken or not adhered to, or if warranties are broken.

- Indemnification provides for compensating either the buyer or the seller, as applicable, for any losses created by the other party’s breach of representations, warranties, and/or covenants.

- Termination as a binding section allows either party to back out of the transaction if the other side fails to live up to its covenants, misstates its representations, or fails to honor its warranties.

Skilled and Sound Legal Guidance

A Stock Purchase Agreement is not a do-it-yourself project. As you can see from the above discussion of the articles contained in an SPA, every detail and agreement must be given careful thought and attention. Both buyer and seller want to make sure they have a way to change or terminate a deal if a material aspect of what either party brings to the table changes in an adverse way.

If you’re looking to acquire a company through a Stock Purchase Agreement in or around Minneapolis or St. Paul, contact Engel Professional Association immediately. You want to make sure that the Stock Purchase Agreement you enter into contains the necessary covenants, warranties, and other clauses that shield you against a deal gone sour. Let us work closely with you to make sure you are fully protected.

The above information is not legal advice and is not a substitute for legal advice.